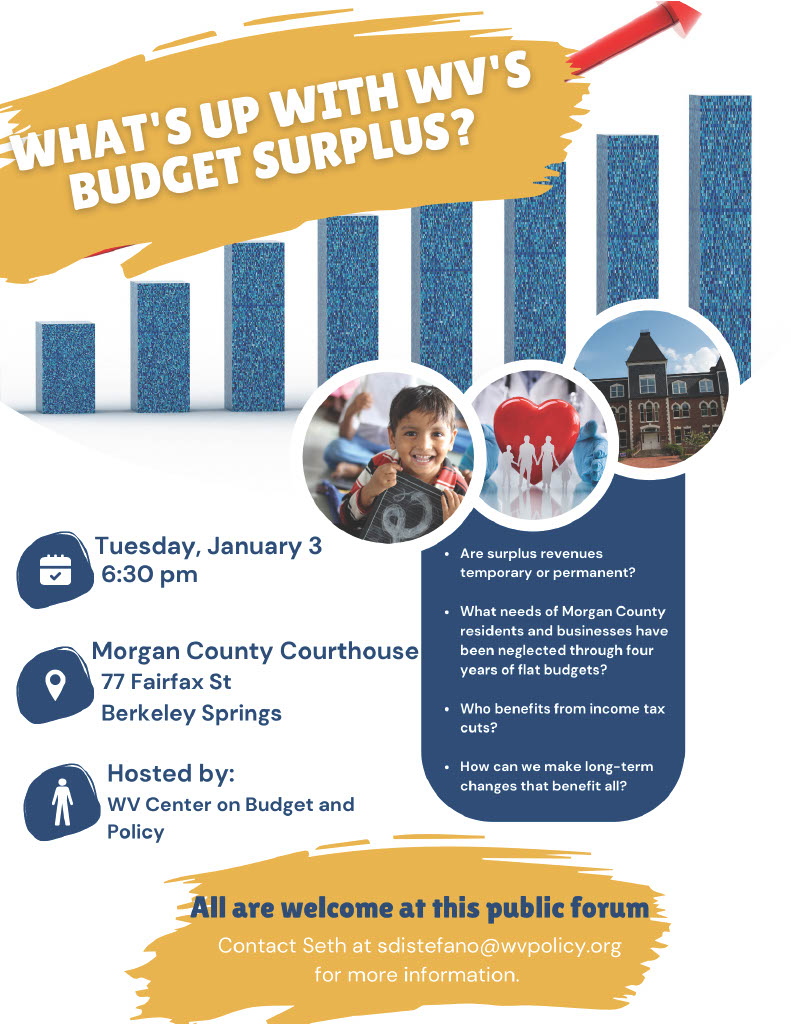

A town hall meeting to discuss the West Virginia budget surplus will be held tomorrow night, Tuesday January 3, 2023 at 6:30 p.m. at the Morgan County Courthouse in Berkeley Springs, West Virginia.

The meeting is hosted by the West Virginia Center on Budget and Policy Priorities and will be moderated by the Center’s Seth DiStefano.

The meeting comes on the heels of a November election that saw the public overwhelmingly defeat Amendment Two, a proposition put forth by the West Virginia Chamber of Commerce that would have allowed the legislators to repeal property taxes on vehicles, business machinery, equipment and inventory.

The public rejected Amendment Two by 65 percent (309,007) to 35 percent (107,013).

The proponents, including the Chamber of Commerce and State Senate leader Craig Blair (R-Berkeley), played up the possible repeal of the state’s vehicle property tax.

But the Amendment was opposed by a right-left coalition that included Governor Jim Justice and the Center on Budget and Policy Priorities.

Passage of the amendment would have given the legislature control over $515 million of property tax revenue, or 27 percent of total property tax revenue in the state, “resulting in the fulfillment of a long-term goal of state legislators to take control of a significant portion of property tax revenue in order to pursue a property tax cut that largely benefits out-of-state businesses,” said the Center’s Sean O’Leary.

“The legislature’s anticipated goal is to eliminate this portion of property tax revenue entirely by exempting new items from property taxation,” O’Leary said. “Businesses – not individuals – would receive two-thirds of the proposed tax cuts under Amendment Two.”

Governor Justice said that one reason he was opposed to the amendment was that it would allow the legislature to give big tax breaks to out of state corporations.

“Everyone wants to pay lower taxes. But, that money builds the infrastructure we need to function as a community,” said Rebecca MacLeod who helped organize the event in Berkeley Springs. “It pays for public safety and rescue. It keeps libraries open, after school programs, water and sewer, and flood control functioning. As long as the tax burden is shared equitably, most of us pay our taxes and the community supports its population.”

“Elected officials decide how the money is allocated,” MacLeod said. “If your taxes are used to improve your community and state, that’s good. But if the money is funneled to large corporations or other financial accounts, as tax and business ‘incentives,’ that’s not so good. Moreover, the state favorability ranking for business hasn’t changed for decades, despite big cuts for business.”